Published on February 04, 2020 by:

This post was originally posted on Mathilde Colin’s medium (here).

–

Once is a fluke, twice is a coincidence, three times is a trend… I’m once again making public the deck I used to raise our latest round of funding!

Based on the feedback I’m getting from readers, this is easily one of the highest-leverage activities for me: it takes about an hour to put together, and then hundreds of thousands of people can see it and use it in their own entrepreneurial journey. The internet is truly a beautiful thing!

The process

Why did we raise money now? The framework I used for our Series A was just as helpful today as it was 4 years ago. It’s all about meeting these 3 requirements:

- Feeling generally good about the business and where it’s going

- Having reached the milestone you had set for the previous round

- Needing the additional resources to reach a new, ambitious milestone

1 is both the most overlooked and the most important one. You need to be confident in what you’re doing, so that you can project this confidence to investors and inspire trust and respect. Strong core metrics are by far the best way to help build this confidence. Not so much because that’s what investors are looking for — of course, being a growing, healthy business never hurts when trying to raise funds — but because if you truly believe that these are the important metrics for your business, then seeing them trending in the right direction will genuinely make you feel good.

Last November I felt good about the business for a few different reasons:

- We had gained unprecedented clarity on how to execute our go-to-market strategy.

- We had brought in great new executives (we had just announced that Anthony Kennada had joined as CMO).

- We had had 3 quarters in a row of hitting more than 100% of our goals — and they were ambitious.

Our current investor showed interest in leading our next round of funding (you can only know for sure when it’s signed, but the signal this sent was very helpful).

With 2 years of runway in the bank, we didn’t need to raise money. Being under the gun isn’t good for negotiations. Regarding #2, during our Series B we stated our intention to 1) become a good email client and 2) build an extensible platform.

We went from 20% of DAUs using Front as a replacement for Gmail or Outlook to 50%. More than half of our customers now use our platform.

This was enough for me to consider these milestones passed.

Finally, for #3, we had established new milestones and a clear need for resources to get there. Our newly defined go-to-market plan led us to make new, big investments. Between our San Francisco HQ passing 100 employees, our Paris office growing 200% year-over-year, and a newly opened office in Phoenix (we’re hiring!), this additional capital would ensure our operations could expand at a steady pace. And, last but not least, the basic premise of Software-as-a-Service is that the software should get continually better (to justify the continuous subscription to the service). Therefore we cannot stop or slow down our investments in building the best possible product. Once it was clear that we were meeting all 3 requirements, there was no time to lose. When it comes to fundraising, setting a tight timeline always plays in your favor. This time around, our CFO told me it would be impossible to make a deck and pitch within 2 weeks; so I took it as a challenge 😁 and we did.

The deck

Feedback I’ve received

If I had to summarize what caught investors’ interest, here is what I’d say:

- Front is a mission driven company (slide 3)

- With a proven product opportunity (slide 6)

- Hiring excellent talent at a fast pace (slide 7)

- Showing consistent revenue growth (slide 14)

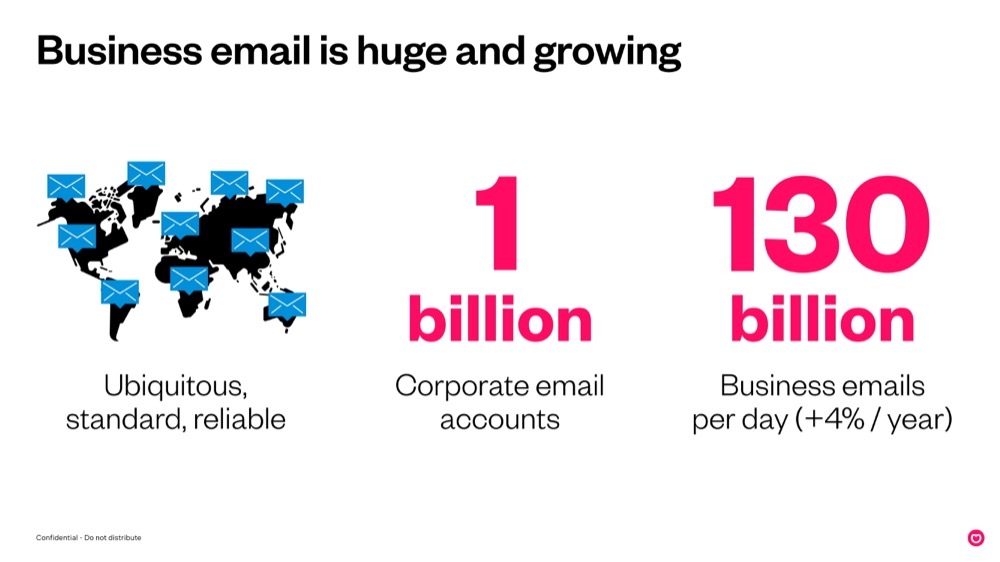

- In a huge market (slide 12)

- Where “hot” companies haven’t delivered on their promise (slide 13)

- Having made significant progress in their go-to-market (slide 14)

- With a very ambitious long-term vision (slide 23)

That being said, we still have a lot to figure out:

- How can we scale inbound traffic?

- How can we talk about Front in a consistent way? (“You mean you’re a help desk AND an email client 😱?!”)

- How can we keep bringing new leaders on board? (We’re hiring for a CPO and a COO right now!)

- How can we balance our long term product vision with the short term, pragmatic needs of fast growing customers?

On valuation

Here’s how I navigated the conversation around Front’s valuation:

I didn’t provide any guidance on valuation. Instead, I simply asked that investors give me a fair price. That, combined with a very short process, helped make the round competitive and eventually played in our favor.

Once again, I didn’t take the highest valuation, but instead optimized for who would be the best partners at this stage of the company.

I didn’t raise more capital than necessary because I wanted to make sure we wouldn’t get too comfortable, take our time, and become complacent. We still have a lot to figure out!

On investors

Raising funds from operators instead of traditional VC funds wasn’t something I had planned. It happened that 2 of them showed interest, offering to invest larger sums than I would have thought. Bryan Schreier, partner at Sequoia and member of Front’s board, then suggested that we structure the round that way. I turned the idea into a deliberate strategy and reached out to a few more people. That’s how we got these super-angels to lead the round.

I’m very grateful for Bryan Schreier and the whole Sequoia team, who have been amazing partners during this process. They wanted to lead the round, but instead always pushed me to do what was best for Front and optimize for the long term, rather than what was best for them in the short term.

Thank you to Emma, Cyril, Jason, and Jenny for helping me during this process ❤️