Published on March 18, 2018 by:

This post was originally posted on Mathilde Colin’s medium (here).

–

A little less than 2 years ago, I shared our series A deck online. This was undoubtedly the most efficient thing I’ve done, since it took me virtually no time at all (it was already done). It’s now been seen more than 2 million times, and I’ve received hundreds of thank you messages for it. Hoping that similar causes have similar effects, since we just raised a new round of funding, I’m making the deck public as well! I hope it’ll help other founders calibrate their story, and be interesting to people working in software and beyond.

Process

First off, why did I raise at the time I did? Founders sometimes ask me: “do you think I should raise now?” The framework I use to answer this, is to make sure these 3 requirements are met before considering a round of funding:

- feeling generally good about the business and where it’s going

- having reached the milestone you had set for the previous round

- needing the additional resources to reach a new, ambitious milestone

1 is the most overlooked, yet the most important one in my opinion. You need to be confident in what you’re doing, so that you can project this confidence to investors and inspire trust and respect. In this regard, strong core metrics are by far the best thing you can have to help build this confidence — not to mention that generally speaking, being a growing, healthy business never hurts when trying to raise funds :)

Last November, I felt great about Front’s business, for a variety of reasons that are laid out in the deck. A few investors had mentioned in passing that they’d be interested in leading our series B — and I believed them, so I decided to initiate a fundraising process.

A few weeks later, we had raised $66M, led by Sequoia and followed by DFJ. I don’t have enough experience to draw general conclusions as to why it went well, but there is one thing I’m pretty sure has helped: I leveraged my existing relationships with one partner in each of the VC firms, to be able to get a partner meeting right away. Building these relationships happened over the course of Front’s entire existence, so in effect, it took me 4+ years to secure this funding :) Build relationships early and maintain them regularly, but keep it short and focused (I usually meet with each firm once every 3 to 6 months).

Feedback I received

The good:

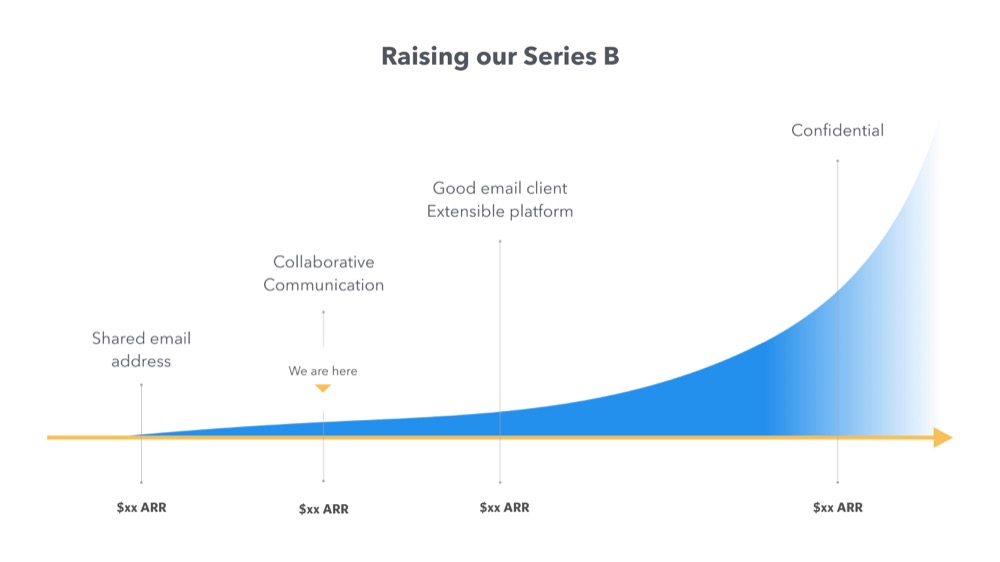

- We’ve painted an ambitious vision.

- We’re in the best position to execute it.

- Front is a “system of engagement”/”system of work”: people spend a lot of time in the app every day, doing a lot of meaningful actions.

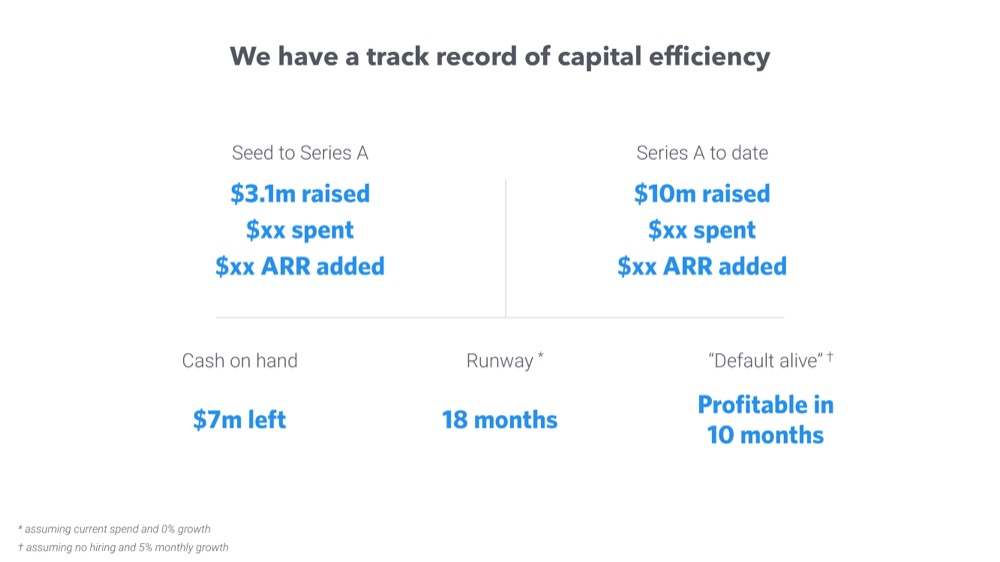

- We’ve grown a lot in comparison to the money we’ve spent. We’ve been very efficient.

- The results have been very consistent.

- The cohorts’ evolution is strong.

- ASP is growing and larger teams are using Front.

- Lead generation results are promising.

- We have a truly special team.

- Portfolio companies using the product had great things to say about it.

- Last but not least, apparently I did a good job at explaining Front. Clarity of communication is apparently something many founders struggle with. Make sure you are an expert at explaining and selling the opportunity in your business.

The not so good:

- The average selling price (ASP) is still low.

- The self-served portion of the business is not that high.

- Our gross churn is a bit higher than we’d like.

- The net number of customers we add every month has been constant.

Tactical advice

- I didn’t provide any guidance on valuation, and simply asked that investors give me a fair price. That combined with a very short process helped make the round competitive and eventually played in our favor.

- I had all the data investors might ask for, and was constantly sending it over to answer the questions they had. That streamlined the process and helped keep the momentum going.

- I did a ton of back-channeling to pick our new board member. Board members sit at the board longer than employees stay with the company: background-check accordingly 😉

- I’m excited to partner with these new investors — I’ll soon write about what it’s like to work with them day-to-day. As for the investors that I pitched but didn’t get to work with (this time), they’ve all been extremely professional and have made the process easy for me, so I’m looking forward to working with them again in the future.